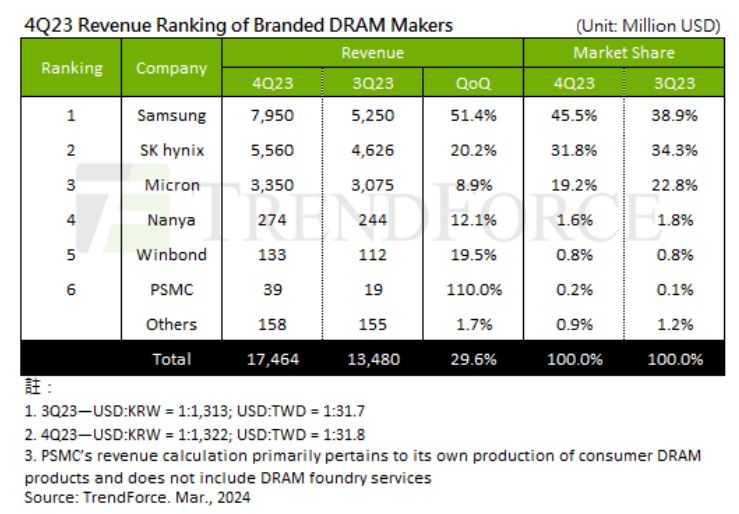

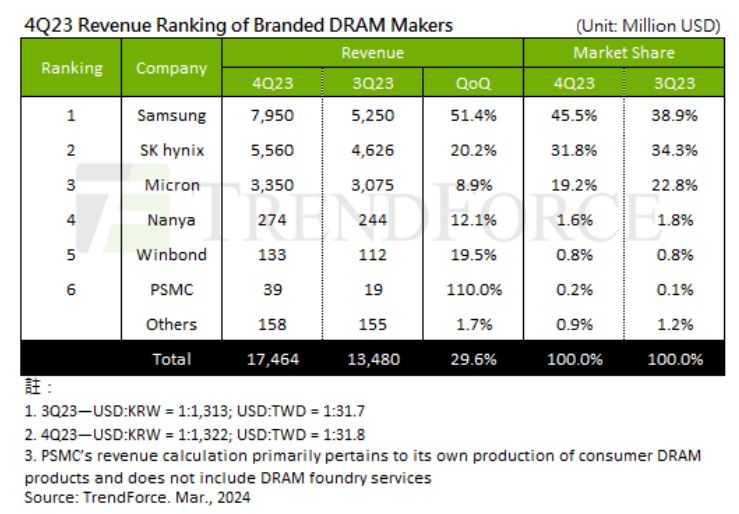

DRAM: 29.6% and NAND Flash: 24.5% QoQ growth in 4th Q 2023. reports TrendForce

Date: 12/03/2024

TrendForce finds fourth quarter of 2023 witnessed substantial growth in both the DRAM and NAND Flash semiconductor market. Driven by heightened demand and strategic production adjustments by leading manufacturers, the outlook for the semiconductor market remains positive as we transition into 2024.

DRAM semiconductor market:

Revenue growth: TrendForce reports a remarkable 29.6% quarter-on-quarter (QoQ) increase in DRAM semiconductor revenue for Q4 2023, reaching a total of US$17.46 billion. This surge was propelled by revitalized stockpiling efforts and strategic production control measures by leading manufacturers.Leading Manufacturers: Samsung emerged as the leader in revenue growth among top manufacturers, recording a 50% QoQ increase to reach $7.95 billion in Q4 2023. This growth was primarily driven by a surge in 1alpha nm DDR5 shipments.

Capacity Planning: Manufacturers such as Samsung and SK hynix are actively expanding production capacity to meet rising demand. Samsung, in particular, achieved an 80% utilization rate in Q1 2024 after significantly cutting production in the previous quarter.

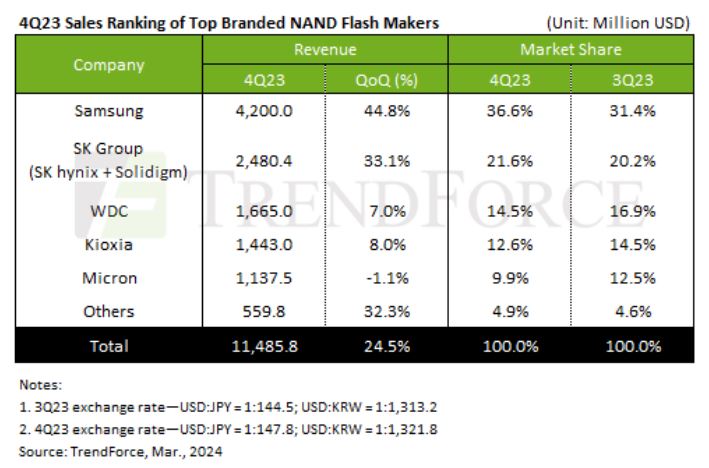

NAND Flash semiconductor market:

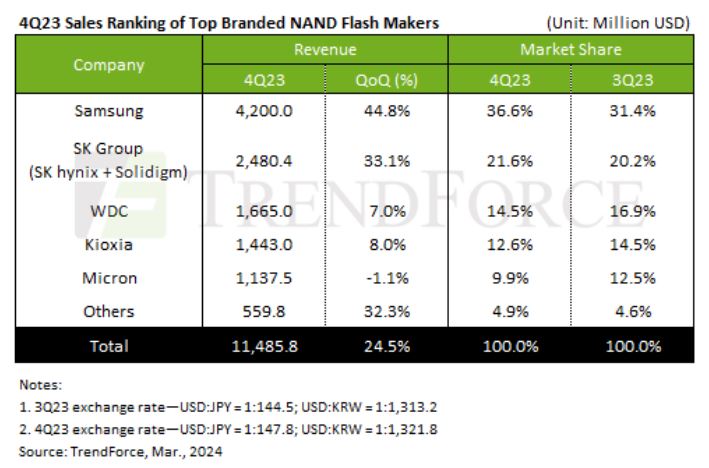

Revenue growth: The NAND Flash industry experienced a substantial 24.5% QoQ increase in revenue, reaching US$11.49 billion in Q4 2023. This surge was attributed to stabilized end-demand and expanded component market orders.

Projected Growth: Despite being the traditional off-season, the NAND Flash industry anticipates a 20% revenue increase in Q1 2024. This growth is expected to be driven by improved inventory levels and ongoing price rises.

Manufacturer Performance: Samsung and SK Group led revenue growth in the NAND Flash industry, capitalizing on rising demand across various sectors.

The DRAM and NAND Flash industries have demonstrated robust growth in Q4 2023, driven by increased demand and strategic production adjustments. As reported by TrendForce, the outlook for both sectors remains positive as we enter 2024. With manufacturers adapting to market shifts and investing in capacity expansions, the semiconductor industry is poised for further growth and innovation.

The figures and forecasts provided by TrendForce underscore the resilience and adaptability of the DRAM and NAND Flash semiconductor memory market. With continued demand surges and strategic investments, these sectors are well-positioned for sustained growth and profitability in the years ahead.