Counterpoint: India’s smartwatch shipments grew 50% YoY in 2023

Date: 08/02/2024

Counterpoint has come out with its latest finding of the dynamic landscape of the wearable technology market in 2023 in India, where it finds India’s smartwatch shipments grew 50% YoY in 2023. This market is driven by proliferation of low-cost devices to target first-time users, and enhanced efforts by Indian brands through extensive marketing and distribution, promotions and local manufacturing, says Counterpoint. Another factor for growth is growing awareness and interest among customers to track their health vitals, utilize the device as a style statement, or leverage it for gifting purposes.

Vendor-wise performance:

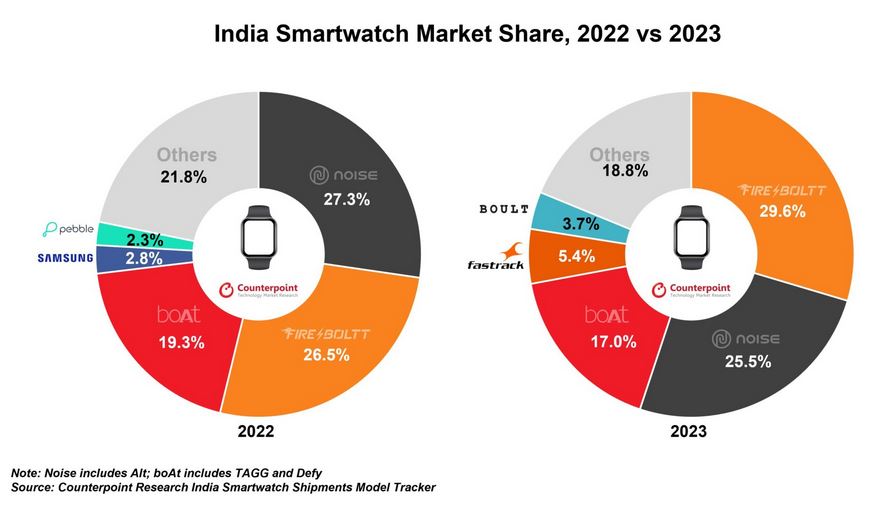

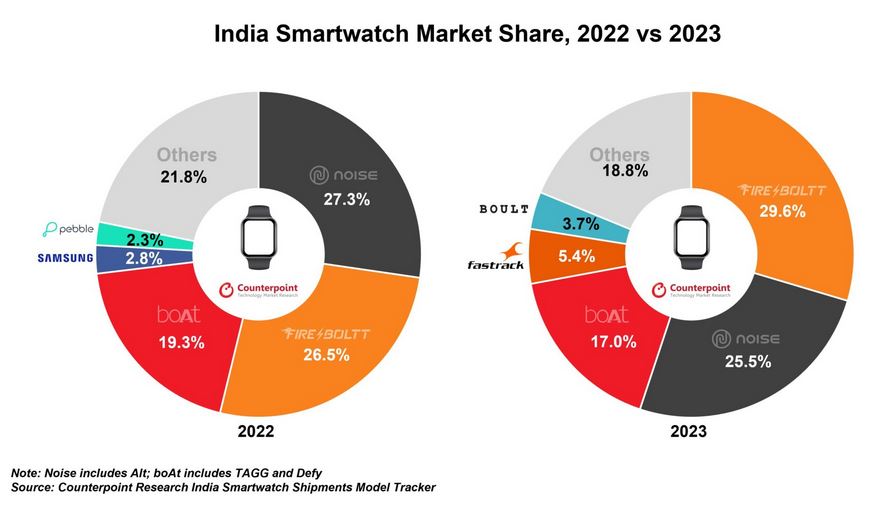

Fire-Boltt asserted its dominance by commanding a 30% market share, solidifying its position as the frontrunner. Renowned for its extensive range of products and robust offline presence, the brand continued to captivate consumers with its diverse SKU portfolio.

Following closely behind, Noise, including its sub-brand Alt, secured the second position with a substantial 26% market share. Noteworthy for its popular offerings such as the Colorfit Icon 2 and Colorfit Icon Buzz smartwatches, Noise experienced significant success throughout the year. Expanding its retail footprint and diversifying its product range, especially in the children's smartwatch category, further propelled its growth trajectory.

boAt, accompanied by its sub-brands TAGG and Defy, maintained its stronghold as the third major player in the market, boasting a 17% share and an impressive 40% year-over-year growth. With a wide array of products and the introduction of its Crest+ OS, along with the launch of limited-edition smartwatches for the Cricket World Cup, boAt continued to resonate with consumers seeking innovation and style.

Fastrack emerged as a notable contender, experiencing the highest shipment growth among leading OEMs, securing the fourth spot with a 5.4% market share. Leveraging its established brand presence and expansive offline network, Fastrack underwent rapid expansion, solidifying its position in the competitive landscape.

Boult claimed the fifth spot with a 3.8% market share, distinguished by its competitive pricing, offering the lowest average selling price among the top five OEMs.

Meanwhile, Samsung faced a slight decline of 3% year-over-year in 2023 but rebounded with a notable 17% year-over-year growth in Q4 2023. The Galaxy Watch 4 retained its status as the best-selling model, attributed to strategic promotional pricing, positioning it as the top-performing WearOS smartwatch in India.

Apple encountered a substantial 57% year-over-year decline in shipments in 2023, primarily due to extended replacement cycles and higher average selling prices, compounded by compatibility limitations with iPhones. Nonetheless, the brand maintained its dominance in the premium retail price band of INR 20,000 and above, capitalizing on increased iPhone sales in India. With a promising outlook fueled by growing iPhone adoption, Apple anticipates a gradual uptick in Apple Watch shipments in 2024.

“The market saw over 125 active smartwatch brands in 2023 even as it started moving towards consolidation. The combined share of the top five brands reached the highest ever at 81%. In addition, growth of emerging players like Fastrack, Boult and BeatXP led to further consolidation of the market. The product portfolio of the top players expanded quite a lot compared to 2022 to cater to different customer segments. Moreover, the market is now further skewed towards the lower price bands with 54% of the shipments in 2023 coming under the INR 2,000 retail price band, up from 26% in 2022.”, said Harshit Rastogi, Research Analyst, Counterpoint.

“While the market continues to register high growth rates, we are seeing some stabilisation, signaling wider adoption. The quarterly growth rates have come down from triple to double digits. We expect the market to grow 23% YoY in 2024. With the introduction of new features like cellular connectivity, high-level OS (HLOS) and better displays, the market is likely to sustain growth. We are now observing that OEMs are tapping into new emerging markets like Southeast Asia and the Middle East and foraying into other wearable categories like smart rings to accentuate their presence in the market.”, said Anshika Jain, Senior Research Analyst, Counterpoint.

News Source: Counterpoint