|

|

|

Electronics Component Sourcing: Supplier

and device selection guide (part-4)

|

Evaluation and selection of semiconductor IC chips and

other parts and their suppliers

The overall quality and reliability of a product depends

upon the selection of right component from right supplier.

A strong and well-built process can help in selecting a

prospective supplier, A stronger inter-connection between

the different functions and teams is key to successul part

selection.

In this competitive market, the probability for the suppliers

to deviate from the normal-intended procedures to capture

the customers is very high. If these deviations are not

thoroughly validated, there can be serious damages caused

to the products, environment, life, and company's reputation

in one or the other form. Suppliers need customers at any

cost and hence the probability of choosing the right supplier

and their qualification becomes more complex now-a-days.

As said in the introductory

sourcing guide, typically 60% of the finished assembly

consists of components derived or purchased from the companies

other than the original equipment manufacturer (OEM). With

the high percentage of dependency on external suppliers

The risk posed to the OEMs is also high if one does not

choose a proper vendor/supplier. Hence choosing the right

vendor/supplier becomes very much essential for long-term

growth and sustenance.

Supplier selection includes various activities such as researching

the market to locate the right supplier; gathering supplier

information such as their technical abilities and products,

market position, customer support, etc; contracting terms

and agreements; negotiating prices and financial terms;

assessing the suppliers for deviations and thus helping

the suppliers to perform better for mutual growth.

A supplier is the one who delivers a product or a service

in accordance to the order placed by the customer (say an

OEM). The choice of choosing the supplier solely depends

upon the sourcing group in consultation with the design

and other functional teams, if necessary. The other functional

teams help the sourcing group in verifying whether the selected

supplier's product meets the design requirements, their

manufacturability, creation of the Bill-of-Materials (BoMs),

etc.,

It becomes somewhat easy to choose a supplier from the list

of potential suppliers. But the hurdle is how to fetch the

list of prospective suppliers who meet the required criteria.

The procurement/sourcing team's skill play an important

role in addressing this issue. However, for new designs

or NPIs, the design engineers, with their limited knowledge

on known-suppliers, are able to provide the component-supplier

information for the buyers. Additional efforts are required

when the OEMs adopt 'alternate-supplier' strategy - to maintain

the list of other potential suppliers for the given commodity

components excluding custom and single-source components.

As said in the introductory

sourcing guide, the supplier information should be gathered,

stored and updated on a timely basis which is required,

right, recent and reliable to facilitate the overall efficiency

of the procurement process.

Why is the second sourcing important, what is the

necessity of having multiple suppliers, Do major and big

companies only require the supplier database?

Few examples are mentioned below that corresponds to the

real-time situations faced by the engineers demanding the

need for alternate sourcing and the importance of the supplier

database.

a. A failed component in an electronic device is

not available in the market due to its obsolescence (end-of-life).

The engineer has to find a suitable replacement from any

other alternate manufacturer so that the electronic device

is repaired. This is more relevent in high-tech components

such as semiconductor ICs.

b. The insufficient stock of the 'hard-to-find' component

shows poor supply chain management process of a company.

c. The component supplier vanishes from the business

due to bankruptcy or business pressure.

d. Natural calamities like the recent Japan's earthquake

create scarcity of components or wafer substrates and thus

the demand for such components grow abruptly. This is an

opportunity for the grey market suppliers.

e. Low-profit or low sale product line closures by

suppliers and hence no customer-support entertained by the

suppliers.

f. Environmental regulations such as RoHS and their

impact in their specific regions and countries can lead

to the unavailability of the non-RoHS components.

In the above examples, one may notice that the business

is suffered ranging from purchasing the component at a higher

price from the black market to the extent of production

line stoppage.

The business impacts are:

a. Production line stoppages, loss of revenue and

loss of wages.

b. Unhappy customer, damage to brand and lose out

in competition.

c. Budgetary limitations or unplanned budget for

procuring components from open or grey markets.

d. Time and efforts required to research for alternate

components at the neck moment thus promote tremendous pressure

on employees.

e. Abrupt rise in the price of the components due

to the heavy demand.

f. Additional testing overheads (UL, CSA agency requirements)

cause further delay in the release and the significance

is even more when the alternate components have longer lead

times.

In order to overcome these challenges or to recover from

these situations, one has to maintain a second or third

sourcing list to 'be-ready' and 'compliant' against the

above mentioned situations.

To save the business from the unseen, sudden and uncontrollable

losses due to the unavailability of components sourced from

the external suppliers, second sourcing and the supplier

database is very much in need for the successful supply

chain operations for any organisation, big or small. Successful

companies do maintain databases such as AML (Approved Masters

List) or AVL (Approved Vendors List) or Sourcing database,

etc., which may or may not be part of the ERPs. These AMLs

or the AVLs contain the list of alternate suppliers and

the corresponding orderable part numbers for each of the

primary component. In case, the component is a custom or

a speciality component, importance is given to stock such

component in enough quantities that depends upon the estimated

annual usage (EAU) and the product life (in years).

Each company follow a different path to choose and classify

the suppliers based on their specific requirements and supplier

ratings, but the overall intention remains the same across

all the companies. The following list of key factors helps

in selecting potential suppliers.

Picture above : Screening funner for potential

suppliers by considering various factors

a. Technology and the innovativeness - product features

and technology uniqueness, patents, joint partnerships with

other leading firms, technology improvements and new product

releases, etc.,

b. Quality, reliability and supply assurance - QMS

Certifications and Quality agreements, field complaints

and failure data, customer rejection data, quality data

from the plant, performance/quality certificates awarded,

etc.,

c. Price, availability and delivery - competitive

price, delivery history, mode of payments and shipments

(payment terms), warehouse location, lead-times, etc.,

d. Regulatory compliance and environmental friendliness

- complying with region, safety and environmental specific

compliances, disposal or recycle methods, non-disclosures

and intellectual property protections, etc.,

e. Customer support and cooperation - process or

product change notices, 24/7 - multilingual customer support

via different means (mail, chat, web, telephonic), support

for surprise audits, etc.,

f. Others - market position, financial strength,

code of ethics, child labour, global presence, etc.,

Once, the list of probable suppliers is gathered, the next

step is to categorize them based on their suitability and

overall credibility. One simple method to classify the suppliers

is to assign appropriate rankings to each one of them based

on the above mentioned individual factors and the information

collected. The ratings can vary between companies based

on their individual requirements.

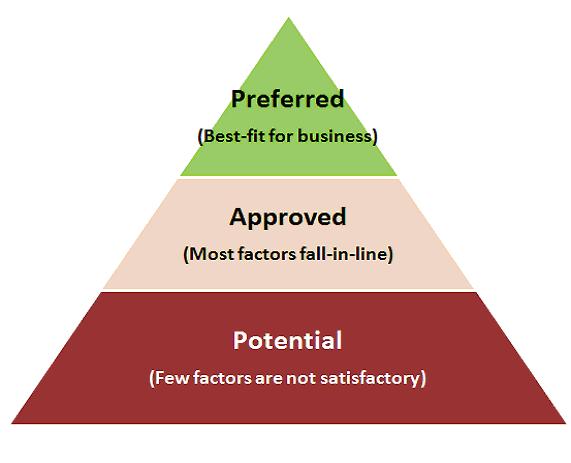

Picture below: Classifying and choosing

the suppliers through evaluations and negotiations

Example: The 5 key factors can be assigned a score which

is based on the importance of the parameter and each supplier

should then be evaluated against these 5 key factors. The

final score obtained for each supplier can be considered

to designate the supplier as potential, approved or preferred.

| Factors |

Score |

Potential |

Approved |

Preferred |

| Technology and Innovativeness |

30 |

16 |

20 |

24 |

| Quality, Reliability and Supply Assurance |

25 |

14 |

16 |

20 |

| Price, Availability and Delivery |

20 |

11 |

13 |

16 |

| Regulatory Compliance and Environmental

Friendliness |

15 |

8 |

10 |

12 |

| Customer Support and Cooperation |

10 |

5 |

7 |

8 |

| Total Score |

100% |

54% |

66% |

80% |

The Potential Suppliers can be classified as the

suppliers which do not satisfy one or more factors and hence

they obtain a percentage of not more than 54%.

The Approved Suppliers are the ones which satisfy

most of the factors and obtain a minimum percentage of 66%

and up to 80%.

The Preferred Suppliers are the suppliers which are

tagged as the best-fit to do the business because their

overall rating at least meets a minimum of 80% and more.

They are the ones which are given the highest priority at

all the times and hence better productivity can be expected.

Note: The ratings and the score given in the above table

is just for illustrative purposes. However, the user can

create a similar score card that suits the individual's

requirements.

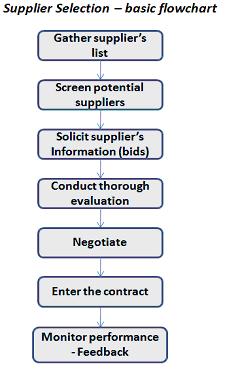

With the help of the above factors and the data, the selection

of the suppliers is performed in the order as shown in the

flowchart below. Using the web and other sources, a comprehensive

list of probable suppliers list is formed. Screening or

evaluating the suppliers based on the data (factors) available

gives the list of potential suppliers. Request the information

such as bid data, contract terms, support, sales history,

financial reports, code of ethics, etc., to further scrutinize

the supplier's validity. Price negotiations and entering

into contracts will be the final step in the supplier selection

process. Stronger supplier relationship and positive results

can be achieved by monitoring the performance and effectively

communicating.

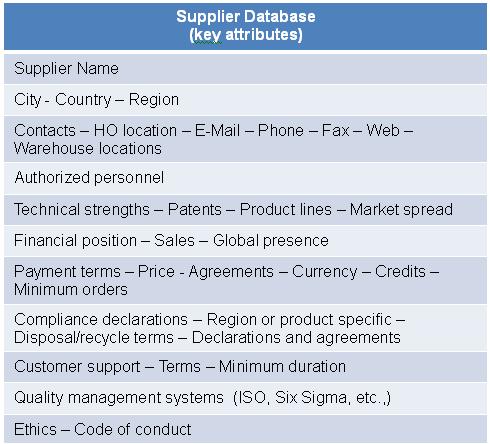

A Supplier database is a comprehensive list of suppliers

and the supplier's information maintained for internal reference

purposes only. The supplier information provides a ready-made

guide for the supply chain, sourcing and design teams to

enrich their productivity. The database at a minimum contains

the supplier's name, contact details and preferred status

(approved, potential, or preferred). The attributes to reside

in the database are company-dependent. The engineers, preferably,

selects the components and services from the preferred suppliers

only as they would have already been evaluated.

For Reference:

There are several advantages of having a Supplier database

in an organisation (both, big and small sized).

a. Serves as a reference database for the design

engineers to select the suitable components from the distinguished

suppliers and hence less efforts.

b. Consolidation of suppliers can be achieved which

in turn creates cost-saving opportunities.

c. Highly efficient collection and validation of

compliance declarations (Certificates of Conformances, RoHS

certificates, Test reports, and Materials declarations)

can be achieved.

d. Decreases redundant inventory and the associated

budget.

e. Promotes productive supplier management.

f. Lesser then number of suppliers in the active

inventory, lower the risk anticipated.

g. Speeds up the product development cycle.

h. Decreases enormous time and duplicate efforts

of the resources.

i. Smart Inventory and parts management.

j. Strengths and weakness (pros and cons) of the

listed suppliers are thoroughly analysed by the Sourcing

team and hence the repeated analysis efforts are eliminated.

As said earlier, the supplier database is not just specific

to the size or the nature of the organisation. Whoever,

wants to adopt a smarter supplier selection and qualification

process, can develop and maintain a supplier database. The

database can be in any form such as MS-Excel spreadsheet,

MS-Access, Oracle tables, and any similar database.

Thus, selecting suitable suppliers and their effective maintenance

is predominantly dependent on the type of the process, tools

and the databases utilized in the organisation. In other

words, the collective information, as highlighted in the

other modules, plays the vital role in the overall success

of the supplier management and in turn the business itself.

General points:

1. The effective collaboration and communication

with the external suppliers is very important for any successful

supplier partnership.

2. International standard procedures are available

to qualify suppliers and supplier's deliveries.

3. Expectations and requirements should be clearly

set with the suppliers.

4. Audits on a periodic (surprise or pre-determined)

basis with the suppliers promotes mutual growth.

5. Due diligence of the suppliers especially at the

time of business pressures to reduce costs is required.

6. Following the market news regularly is beneficial.

Author:

S Jaya Kumar, Consultant, Component Supply Chain Management

Conatct

him at:

Find below links to other parts of

the article on the same subject of smart component sourcing:

Part1:

Smart component sourcing is about green, clean, rugged,

and the $:The

basics of modern component buying methodologies are explained

in these series of articles.

Part2:

Counterfeit components: Methods to protect against fake

parts: Save reputation,

severe loss of time and money by not buying fake parts

Part3:

Green Component Sourcing through environment conscious part

selection: Selecting

electronic components causing no/least harmful to environment

Part

5: The principles and process of electronic component selection:

Component Selection; "an art" for SMART and cost-effective

designs

Part

6: Electronic components Life Cycle management:

Methods to manage sourcing issues of obsolete components

Next: Component lifecycle/obsolescence management (yet

to be published)

|

| |

|

|