Semiconductor market 2017 spiked by DDR DRAM and flash memory chips

Date: 17/04/2017

Semiconductor memory chips again take the control of semiconductor market in 2017, the overall semiconductor market started growing in the 1st quarter of 2017 itself due to the growth of DDR4/3 DRAM and NAND flash memory chip sales. Smartphone buyers are preferring smart phones with higher DRAM, so that it runs faster with multiple apps running in the backgroud. Without any doubt, one of the attribute for the growth of semiconductor market is the offering of free data and voice calls by Indian telecom service provider JIO, where it insists people should have 4G phones for the SIM to operate. So more people in India started buying 4G smart phones to avail the free data and voice calls benefits. The cost of the phone not really mattered compared to the money they can save by having free data and voice calls. A smart buyer would prefer to buy a 4G smart phone phone with higher DDR DRAM memory in their smart phones.

Not only during this season, even during PC market boom, the DRAM and SRAM market growth has given a big boost of growth to the semiconductor market in early and late 90s. But it was dangerously risky business for memory makers who have seen sudden rise and fall of sales revenues.

Is this market growth a just blip, or does it last longer ?

Our analysis tells the blip not going to be that sharp, though the growth rates may fall to some extent, but the market will still grow at slower rates, at least for some quarters. In that sense 2017 going to be good year for semiconductor market.

To tell you what other market researchers are forecasting and analysed semiconductor market for year 2017 . Below is what we share:

SIA semiconductor market analysis:

The Semiconductor Industry Association (SIA) reported the global semiconductor industry posted sales totaling $338.9 billion in 2016, the industry's highest-ever annual sales and a modest increase of 1.1 % compared to the 2015 total. Global sales for the month of December 2016 reached $31.0 billion, equaling the previous month's total and bettering sales from December 2015 by 12.3 %. Fourth quarter sales of $93.0 billion were 12.3 % higher than the total from the fourth quarter of 2015 and 5.4 % more than the third quarter of 2016.

SIA also announced worldwide sales of semiconductors reached $30.4 billion for the month of February 2017, an increase of 16.5% compared to the February 2016 total of $26.1 billion. However global sales in February was 0.8% lesser than the January 2017 total of $30.6 billion according to SIA. The February 2017 is largest year-to-year growth since October 2010. The figures shared by SIA are compiled by the World Semiconductor Trade Statistics (WSTS). SIA attribute the growth strongly to memory products like DRAM and NAND flash chips.

China grew by 25 %, Americas by 19.1%, Japan 11.9%, Asia Pacific/All Other 11.2%, and Europe by 5.9%. Month-to-month sales increased modestly in Asia Pacific/All Other by 0.5% and in Europe it reduced by -0.6% , Japan down by -0.9%, China down by -1.0%, and the Americas down by -2.3%, as per SIA.

Gartner's forecast for 2017:

Gartner forecasted a total global semiconductor revenue of $386 billion in 2017, an increase of 12.3 percent from 2016. The growth begin in the second half of 2016, particularly for commodity memory, have accelerated and raised the outlook for the market in 2017 and 2018. However, the memory market is fickle, and additional capacity in both DRAM and NAND flash is expected to result in a correction in 2019, says and warns Gartner.

The ASP cost too mattered : Gartner shared the PC DRAM pricing has doubled since the middle of 2016. A 4GB module that cost $12.50 has jumped to just under $25 today. NAND flash ASPs increased sequentially in the second half of 2016 and the first quarter of 2017. Pricing for both DRAM and NAND is expected to peak in the second quarter of 2017, but relief is not expected until later in the year as content increases in key applications, such as smartphones, have vendors scrambling for supply.

The end market analysis by Gartner: Unit production estimates for premium smartphones, graphics cards, video game consoles and automotive applications have improved and contributed to the stronger outlook in 2017. In addition, electronic equipment with heavy exposure to DRAM and NAND flash saw semiconductor revenue estimates increase. This includes PCs, ultramobiles, servers and solid-state drives.

Internet of Things (IoT) and wearable electronics is still too small according to Gartner to cause some bigger market impacts on chip market.

DRAMeXchange: DRAMeXchange estimates that the average contract price of 4GB DDR4 modules will go up by about 12.5% compared with the first quarter, from US$24 to around US$27.

The memory semiconductor vendor analysis shared by DRAMeXchange includes :

1. Samsung has started to mass produce 18nm PC DRAM products since the middle of this year’s first quarter. Transitioning to a higher level of manufacturing technology tends to create difficult design challenges, and Samsung has found that some of its memory modules are having compatibility issues with certain notebook platforms. The high defect rate from the 18nm process has hindered the supplier’s shipments. As Samsung is attempting to resolve the product quality problem, its contribution to the market supply will be severely limited.

2. Micron has also started sending its 17nm PC DRAM products to clients for sampling since the first quarter, but the entire process is taking much longer time than expected. Micron is likely going to delay mass production for its 17nm process beyond this second quarter.

3. Among the big three suppliers, SK Hynix is only one that is not transitioning to a more advanced manufacturing technology for its PC DRAM and is not shown to have problems in delivering its products. Wu pointed out that Samsung’s and Micron’s predicaments reveal that design and manufacturing barriers become a lot higher when it comes to migrating to under-20nm production. At the same time, such migration efforts result in diminishing returns in the form of shrinking bit growth. Significant improvement in the market supply situation therefore is expected to come much later.

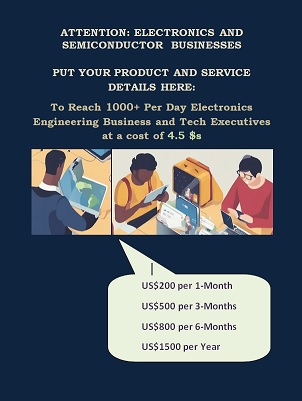

Immbg content_semrev17.PNG

Picture above: semiconductor revenue chart based on Gartner figures